So what does this mean in terms of the homogenous marketing behaviours of the sector and where do we go?

ESG funds have attracted record inflows during the Coronavirus pandemic period, not simply as an environmental or responsible reaction but for stability and a longer-term view. The pandemic has turbocharged sales of ESG funds, as investors look for sustainable business models that can withstand market shocks. This rapidly adopted space is seen as a shooting star for active managers impacted by shifts towards passive funds by investors.

According to Morningstar*, funds that invest according to ESG principles attracted net inflows of $71.1bn* globally between April and June this year. This translates into a new high of just over $1tn AUM in ESG funds*. There are now more than 2,500 sustainable funds available to European investors*, both open-ended and ETFs – this has more than tripled from just a decade ago. This growth demonstrates that asset managers are responding to institutional and investor demand for investments that align with their sustainable preferences and values, as well as performance.

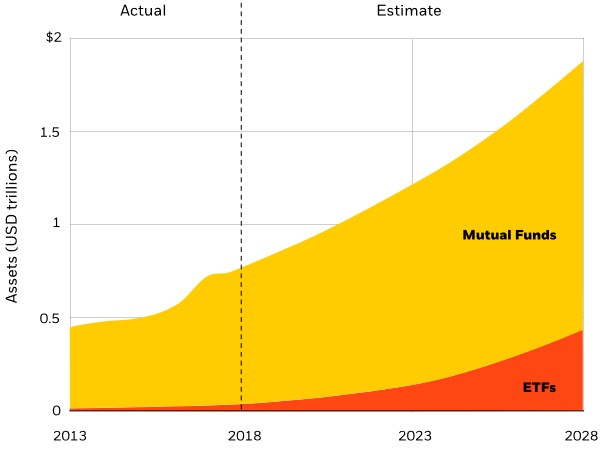

When look at the forecasts at the end of 2018, you see where the sense of appetite for ESG was heading then. (*Broadridge/Simfund, June 2018.)

However, it is obvious that the unforeseen pandemic has massively accelerated this growth. The latest post Lockdown 1.0 estimates that this could exceed USD 100 trillion mark by 2030, according Deutsche Bank. Some serious growth.

It’s incredibly positive to see the shift adopted by so many major asset managers however, when some state that all they do now is Sustainable Investing, it sends a wake up call to the market about the future of asset management and ESG, and also a wry but welcoming smile from those long established in its principles. This rapid market adoption by managers, built in most part on the need to halt outflows and lap up inflows has led to a record number of sustainable funds being launched in Europe in 2020.

But there are many managers new to ESG, attempting to claim their heritage in the space, who have been left exposed, having to cover their wake in PR. Revelations around poor practices by companies invested in can leave reputation in limbo at best. Only recently 20 sustainable funds invested in fast-fashion retailer Boohoo, hit with allegations of poor working practices, demonstrated the risk of over claiming and exposure with in-depth research, close governance and real awareness of the assets they invest in.

This brings into light, the greater need for universal ESG standards – much like trading standards with simple traffic light system within each of the areas. The UNPRI provides a good base point but as time is going by its clear that a universally set and monitored set of standards needs to be put in place. Without this, it could devour all the good that ESG is setting out to do, and vitally further damaging the publicly tarnished reputation of the investment sector. Will a call for tighter regulation and standards help sort the genuine article from the alternative? We’ll have to wait and see, but for now it seems everyone’s in the game.

Is ESG sustainable?

In short, if greenwashing or green hoping, the art of overlaying at best or the empty unsubstantiated claims of some managers go unchecked, the great opportunity for the investment industry and its investors to have positively contributed to a world of change, will be missed.

The success of ESG, sustainable investing or the greater sustainable will sink or swim on authenticity and trust, as much as long term performance. Trust that managers are investing in the right way, with the right guiding principles, robustly researched and highly active in the companies they invest in. Authentic and open about their own truths and histories surrounding ESG and their path to its nirvana.

If the industry fails to recognise the importance of authenticity and market their brands and funds accordingly at every step, belief in ESG itself could begin to crumble. The investment industry has the responsibility for the success of ESG and sustainable investing and the benefit it can bring to the world, and clearly itself. To do so must be for ESG to hide no doubt or disingenuousness – the truth must be plain to see – authenticity and integrity must prevail.

In short, sustainable investing is sustainable. With greater concern over environmental and social factors, and the way businesses operate around the world, it is not only a global shift and a thirst that needs quenching with ESG investing, but a global imperative for change. In David Attenborough’s most recent program ‘A life on our Planet’, he clearly identifies the opportunity placed on us with the investment industry to be part of the global chain of positive change that can save our planet and human-kind with it. He talks of the importance of ESG and sustainable investing with conviction, and vitally, hope. As my personal hero, he speaks only the truth and now remarkably 94, is still campaigning for change for those yet to come and a future he knows he will not see.

So our role is vast.

The investment industry must not dilute its good intentions and principles to simply prop up revenue, overhead and expenditure models. With that responsibility we must limit any negative perceptions with good corporate and investing behaviour and performance.

Conventions that aren’t so sustainable: Homogeneity

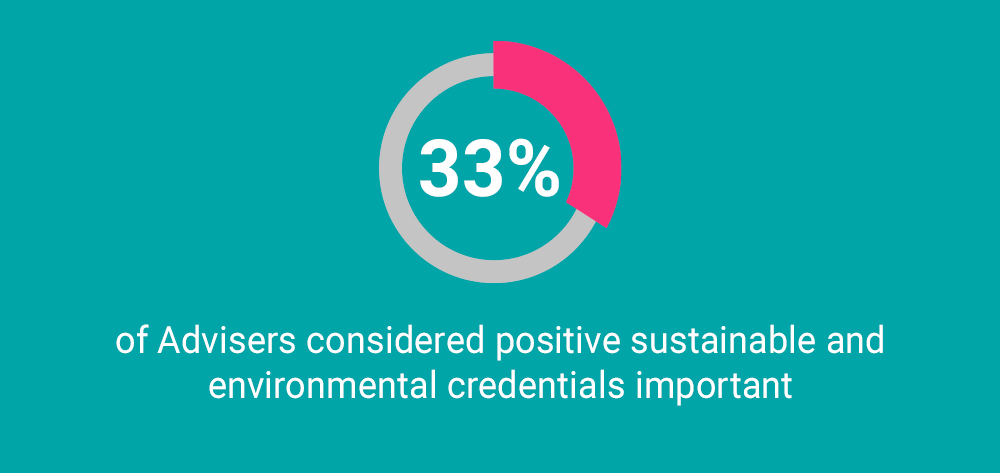

Last year we undertook two adviser research programs to gain insights about what they want and think. One of the key findings was around appetites and demand for ESG. Positive sustainable and environmental credentials were considered increasingly important by 33% of advisers, closely followed by social and ethical impacts identified as key by some 28% of advisers. However, only 7% of respondents selected ‘company reputation as being ethically responsible’ as a key reason for selecting an investment firm and only 1% identified ‘being good at ESG’ as a key motivator.

Since this research was undertaken, there has been significant evidence which has moved the dial. The Covid pandemic has not only concentrated global appetites for ESG but has created a hurried shift for many managers rushing to adopt its virtues to arrest outflows and get involved in the inflows. All the statistics demonstrate this. In our next phase of adviser research, we will no doubt see a significant increase in all of these factors.

It would be no surprise at all to see in the next round of research how quickly asset managers and ESG propositions have become homogenous in this area, making it harder to tell apart a good and genuine manager or fund. This is something which has become much more widely evident as 2020 has unfolded and no doubt will continue apace into 2021 and beyond (so long is ESG’s credentials are not eroded by poor levels of integrity).

What has captured the imagination of the majority of the asset management industry, is the very thing that now needs it. We need to reimagine the rapidly adopted marketing conventions of ESG and sustainable investing that is making it so challenging for advisers and institutions to tell propositions apart.

While there have been quite a number of strong exponents of responsible, sustainable and ESG investing over the last couple of decades or so, the last 24 months have seen a big shift by the industry to play catch up. The global shift in human attitudes, in part brought about by a timely collective global social and environmental consciousness, a decade of the anti-capitalist movement, environmental and social activism has helped a transition to individual responsibility to what is a ‘good’ investment.

However, this is still yet to explode further in the advent of a second coronavirus lockdown in many countries around the globe. Aside from taking a longer-term view on performance, the key drivers for asset managers and their clients are reputational risk exposures from being seen to invest in badly run businesses, poor social considerations and exploitation.

Now is an all important moment for managers and the industry to grasp to ensure that the influence it has on the world is a positive one, while still being able to generate revenues.

The Great ESG Gold Rush has become a race for conformity

The clambering for place in amongst the ESG hall of greats with institutions and wholesale markets, has created a foot race. We now have the great ESG gold rush with managers aiming to stake out their place and win AUM in this great moment of opportunity. There’s no doubt that underneath it all it is a well-intentioned run but what has happened is effectively a race for conformity.

This ESG Gold Rush and its subsequent race for conformity has in many cases created hurried marketing, resulting in high levels of homogeneity, new and in most cases obvious conventions, with everyone using the assimilated language, visual metaphors, with all but a few being differentiated.

These conventions are being created by the good, and indeed the great, and also those who are less of either, in the process putting at risk the integrity of ESG and sustainable investing. As these conventions are so easy to adopt, it means that managers with lesser degrees of ESG authenticity are able to use visual and messaging overlays to equal those who are genuine in their sustainable qualifications.

This has greater risks to the success and continued growth of sustainability and ESG investing. With lesser qualified or authentic manager propositions looking the same as the more genuine ones, distrust in ESG could set – a rot which could damage the vital benefits and outcomes that will shape the very future of humanity. Now that seems like a big statement, but every small erosion of trust could sweep across like a viral wildfire of human perception with effect being people switch back their normal mode of investment, with a continuance of exploitation.

Conventions that aren’t so sustainable: Homogeneity

It’s hard to disagree, that much of the messaging within the investment sector is pretty high on homogeneity. For the creators of brands and messages, so many times we’ve heard the lines “When you look at…”, “we want something like…” and so forth. Indeed, there’s safety in numbers and few wish to break out from these conventions, after all they are the rules that everyone else obeys. For many years, those operating in the responsible, sustainable or ESG investing space had a clear point of differentiation. Their stories, positioning, values and propositions were different. For anyone operating in the conventional or alternative asset classes, ESG and sustainability was unknown, not on the radar, overlooked or was simply ignored hoping it was merely a fad.

Now with the wind behind it, ESG is the direction of travel for almost everyone. With everyone adopting, the market is in growth and it’s inevitable that, much like asset management in general, much will become rather ‘samey’.

Whether its responsible, impact, ESG, sustainable investing, the visual and messaging conventions remain on the whole pretty universal.

Images of turbines, green fields, children, oceans, plastics, mountains and more, its clearly evident that there is a universal visual language.

But, it goes further, when you look at the number of organisation in the top 20 Asset Managers, the language is ubiquitous for ESG. You’ll also see the reinvention of sustainable histories littered everywhere.

ESG helps us be better investors, for our clients, and for the world around us. We’ve been using our voice to drive positive change for almost 50 years.**

“Outcomes for all” “The world around us.” “drive positive change” “PERFORMANCE AND POSITIVE CHANGE”

Within a homogenous proposition market place the only winners are those who speak authentically and uniquely, and the big brands.

For the big brands, the fact that homogeneity is already rife in this growing ESG space means that brand, scale and market access will win out. However, this will only be the case in the long term, if these big brands have true authenticity in ESG now and everyday. As brands try to buy their way into the ESG space and some even create new histories for themselves, we must ensure that authenticity and true differentiation reigns, in order to continue to captivate audiences and investors and ensure a positive sustainable future for ESG.

This is why it’s more important than ever that many managers remain in the game. To do so, asset managers need to get to grips with their true ESG commitment, viewpoints and be up front and completely honest about how they are approaching ESG and why.

It’s okay to have come later to the Sustainability party. It’s okay to introduce overlays and begin the process of embedding ESG principles but not be fully integrated yet. It’s a journey and being authentic about it is better than creating a new history built on spurious historical behaviours or claims. It is about building on what you have to get to the point of introducing ESG values into your investing approaches and corporate story. You can’t just paper over the cracks with ESG as you’ll get found out more readily. It has to be authentic for you, not just the conventions of the market.

And it’s this that is a key point.

So what does the marketing future look like for ESG?

How do asset managers differentiate through marketing when ESG seems to have become a collective USP?

In sustainable investing, authenticity counts. It’s about being true to your investing and corporate approach, philosophy and styles and how this fits with the varying levels of requirement of ESG, sustainability or responsibility. It’s about avoiding false or vague claims at all levels. Many will recognise that for most asset managers, this IS something different, new and rapidly evolving. Most institutions and even intermediaries will not depart immediately if managers don’t always qualify to the highest rigorous ESG standards yet satisfy the investors requirements for balance and performance, and existing investing style of the asset manager.

Being true – Above all, to create a ‘sustainable brand’ you must be authentic. Don’t reinvent your history to fit with ESG. Be true, honest and up front about how far you are, how far you’re going, where your ambitions lay for ESG and your brand. Whether you’re migrating, changing, integrating or overlaying it, what matters is clarity and transparency.

Behaviours – Brands aren’t what they say, they are what they stand for and what action they make from it. It’s about transparently true behaviours. Cultural shifts don’t happen overnight, they evolve. What is within them and how they become embedded defines the success of adoption and the authenticity of them externally.

Go beyond homogeneity – Creating differentiated narrative built around where you are, what you are, your investment and your corporate philosophy that is unique to your manager brand is key. Within every asset manager is an individual story dying to be discovered, without the need to use the same words, pictures and claiming of a new history. Look within the business for answers and then beyond the space to create a true and engaging truth that you can package. This will help deliver the evolved and true narrative to carry your solutions and funds to all audiences, retail, advisory or institutional.

Substantiate – There’s nothing like an empty promise.

Too many claims lack or don’t bring to the surface the real gritty detail which substantiates a narrative. When you look to the very few who are doing it well, you will see that all the sustainable investing narratives are built on creating a substantiating theme, for the manager or the approach to the asset class, the fund and so forth. Substantiating the sustainable claim in proof points, the stewardship details, the on the ground factors, the actual behaviours that are demonstrable, aid the integrity in the product, service or people.

Deep discovery for a true & differentiated investment & corporate brand narrative & expression – No matter what scale you are at, if you are intent on being an authentic force or being seen as one in sustainable investing, then evolution is vital for success, or survival.

Perception is reality, until of course the reality is a mismatch between what we were sold and what we experienced, then that becomes the new reality. If the book cover gets readers to read, then our content and everyday marketing actions must live up to it. Content, storytelling, the visual exterior can be true, differentiated and engaging. I believe that every asset manager has its own unique story to be told, however, this is so often seen as a subject too fluffy for the hard-nosed commercial ideals of investment. However, ESG has brought out the softer more emotive side of our world of facts, numbers, structures and algorithms. The investment and corporate brand stories must now align with ever more connection between the two – we are our product. In all of these aspects, digging deeper within the corporate vision, the commercial strategy, the corporate culture and the investment philosophy exists, something that is unique to each asset manager. Just like DNA, there are nucleotides – the fundamental building blocks. As with any other brand in a mature marketplace, with a developing responsibility we must define what makes our ESG story unique and worthy of trust and investment.

Our visual references don’t need to be the same as everyone else’s. As we all know, quite often this is merely apathetic or unimaginative strategic or creative direction that makes us assimilate – conscious or subconsciously. Visual reference points can be built on strong foundations when you explore what is underneath the manager or fund. The answers are there to be discovered and shared. Our language can have a difference by sticking to what we know, what is true and where we are in the cycle of adoption, and aligning this to our brand values and philosophies.

Now is the time of ESG, and to truly succeed in growing market confidence as well as AUM, asset managers need to be part of building a truth, building a compelling global story and brand narrative through our clients and distribution channels and beyond, to inspire action, investment and change.

We are part of that change. We see our role in helping create and tell these true narratives. Yours is to live them.

Andrew Golding

Director – Strategy & Innovation

2112 Communications Limited